Q3 & September 2025 Update & Fund Commentaries

Here with your latest quarterly and monthly updates. In this edition, we take a look at the key factors that shaped the investment landscape in Q3 2025, along with a quick wrap-up of September’s market activity, plus some portfolio updates happening in November.

As always, these insights are brought to you by our partners at PortfolioMetrix. We hope you find them informative and worthwhile.

Sending love,

Richard & the F&A team

This piece is compiled by Philip Bradford, Head of Global Investment Strategy - PortfolioMetrix

This message includes the Quarterly Investment Update for Q3 2025, the September 2025 Monthly Update, and also a short write up on some upcoming portfolio changes. If you would like to jump ahead to each of these, please click the links below:

From factsheet to reality: Bridging the Investment performance gap

In investments, it is very seldom that the portfolio manager and the investor experience the same return figures. We’re going to explore two ways to measure performance and unpack where the portfolio manager’s responsibility starts and ends.

SPOILER: investor composure is only part of the story.

TWO WINDOWS INTO THE INDUSTRY

Fund performance can be measured in two main ways, and each tells a different story. The time-weighted return (TWR) is the figure you see on a fund’s factsheet; it measures how the investment itself performed over time, ignoring any money flowing in or out. In essence, TWR answers, ”How did the fund do, if we assume a fixed investment throughout?”. The money-weighted return (MWR), by contrast, accounts for the timing and size of contributions or withdrawals, reflecting how an investor in the fund performed. This is aligned to the return on the investor’s statement. Clearly these are not the same.

SO WHY DOES THE INDUSTRY HAVE TWO MEASURES OF PERFORMANCE FOR THE SAME FUND?

Traditionally you’ll be told to think of TWR as the fund manager’s scorecard as it isolates their skill by removing the impact of investor cash flows (I’m going to challenge this assertion). MWR, on the other hand, shows the investor’s experience; it is the result of not only the fund’s performance, but also the investors’ money-weight exposure to the fund.

In a perfectly steady world with no cash flows, TWR and MWR would be identical. But in the real world, they often diverge whenever investors pour money in or withdraw money out at various times.

THE “BEHAVIOUR GAP”: WHEN INVESTORS EARN LESS THAN THE FUND

Investors often find that their personal returns (MWR) are lower than the fund’s published returns (TWR). This shortfall is commonly called the “behaviour gap,” defined as “the difference in return between what the factsheet shows and what our investment actions delivered”. Why does this gap happen? Well, a foundational principle of investment management is a concept of “the rational investor”, which we don’t believe exists, in large part because real people don’t invest and forget, we get excited and fearful.

Studies by Morningstar (their annual ‘Mind the Gap’ study1) have found a persistent pattern: investors tend to buy high and sell low, chasing performance on the way up and panic-selling on the way down. Over time, this behaviour can cause investors to consistently underperform the very funds they invest in. It may only be a percentage point or so each year, but that small annual drag adds up; over 30 years it could mean a retirement nest egg that is 40% smaller.

There are a few serial offenders that cause investors to behave this way, but volatile funds such as thematic investments lead the way. The exciting storytelling of clean energy, or artificial intelligence, are often the highest-flying funds on paper (TWR) but can deliver the poorest investor experience (MWR) in practice.

WHEN HYPE UNWINDS: A REAL-WORLD EXAMPLE

Let’s look at a recent example of the behaviour gap in action. The iShares Global Clean Energy ETF became a star performer in 2020 with a 140% return that year. Excited by this success and the headlines surrounding it, investors piled into the fund, doubling the fund size by January 2021. But the hype didn’t last, and the theme rolled over. Assessing the fund over a five-year period reveals a handsome factsheet return was +17% per annum (TWR), however, the average investor in that ETF actually lost about 3% per year (MWR).

That’s a staggering ~20% performance gap, and the flag that is common across most experiences such as this one is a compelling theme or narrative that can entice investors at exactly the wrong time. The hype fades and investor allocations, and often returns, unwind.

Why do we not learn our lesson? Brandon Zietsman explains how our relationship with an uncertain future often drives us to seek comfort in stories and trends. Author Morgan Housel states that we “crave certainty and are attracted to complexity. Good stories persuade us far more than facts”.

WHO BEARS RESPONSIBILITY FOR THE GAP?

Given this gap, a crucial question arises: who is accountable for it? Traditional thinking might say the investor is responsible for their timing decisions. However, an investor-centric solution (like that of PortfolioMetrix) suggests shared responsibility. If a fund’s design or the way it’s promoted encourages counterproductive behaviour, the manager should arguably bear some responsibility for the outcome. For example, a fund that aggressively touts its exceptional past returns might inadvertently lead people to buy in at peaks. In such cases, the manager’s scorecard shouldn’t just consider TWR, but also how investors actually fared via MWR (a customer survey so to speak). Did the majority of investors in the fund capture those high returns, or did they suffer a large behaviour gap? A truly skilled manager (or strategy) would ideally produce good TWR and help investors stay the course to realise those returns. The factsheet and the investor’s statement would be close cousins rather than distant strangers.

THE PORTFOLIOMETRIX APPROACH TO BRIDGING THE GAP

Historically the burden of reducing the behaviour gap has been passed to the adviser like a hot potato, or simply blaming bad investor composure. We believe the answer lies in those traditional practices, and in better portfolio design. On the portfolio side, it means constructing diversified, robust portfolios that investors can live with through thick and thin. Avoiding single-factor risks, and identifying the investor’s Financial Personality, mapping them across into their composure zone, and ensuring they invest in a solution (not a product) that best suits them and their financial goals. These concepts are in our DNA at PortfolioMetrix. We aim to engender trust by building strategies that don’t rely on chasing the latest theme or taking extreme bets. A well-diversified, risk-managed portfolio may not shoot the lights out in any one year, but it also won’t inspire the kind of boom-bust behaviour that leads to large behaviour gaps.

We aim to compound consistency into long-term outperformance, an investment strategy that complements the adviser’s value-add, builds trust, and helps us all sleep well at night.

Q3 2025 Update & Fund Commentary

Our Quarterly Commentary aims to carry and share the bulk of our reflections and analysis of the previous quarter. To help cater to your preferences, we've provided various avenues for navigating through an entire Quarter's worth of news and data.

You can view the full recorded feedback session (± 52 minutes) here for a deep dive into the last quarter

The presentation slides are also linked below

And for the real meat, scroll a little further to find the full detailed commentaries on both South African (9 pages) and Global markets (8 pages) and portfolios

To catch up on past insights, please visit our blog for a recap of previous commentaries.

And, of course, if you'd like to engage in further discussion, please don't hesitate to reach out. We're always here and ready to chat.

PortfolioMetrix Recorded feedback session

The PortfolioMetrix team has recorded their feedback session, discussing a few key aspects from this last quarter. We trust you'll enjoy and find this summarised commentary valuable.

In this quarter’s update, Phil Bradford explored gold’s recent outperformance and the investor behaviours it has triggered. He unpacked the key drivers behind gold’s price, real interest rates, debt burdens, and geopolitical tensions while highlighting its unpredictable nature and the outsized impact of a few standout years.

Phil challenged the idea of gold as a reliable hedge or growth asset, describing it as a “chameleon” whose role shifts with market narratives. He urged investors to be clear on their reasons for holding gold, noting its volatility, lack of income, and inconsistent protection during crises. The takeaway: gold can play a role in portfolios, but only with clear intent and realistic expectations.

Whether you missed the live session or want to revisit the insights, the full recording is now available below.

Quick timestamps for your convenience:

1:26 – Gold’s strong performance

18:21 – Long-term inflation protection

26:14 – Gold vs Equity

43:27 – Global portfolio series

The Quarterly Feedback Session & Presentation Slides are linked below:

For the full Local & Global Quarterly Fund Commentaries, please click the links below:

Local Fund Commentary

Provides a commentary on the past quarter, its events and their impacts; as well as more intimate commentary on each moving part within your portfolios.

Global Fund Commentary

Provides intimate commentary on each moving part within your global portfolios over the past quarter.

September 2025 Update

Global Update | September 2025

Provides an overview of current global market dynamics and essential insights.

Local Update | September 2025

Provides an overview of current local market dynamics and essential insights.

Performance Links

South African (ZAR) Solution Rebalance

At PortfolioMetrix, we are continuously monitoring client portfolios to ensure they remain aligned with their strategic objectives and agreed risk mandates. Following recent market movements, we will be implementing a rebalance across all portfolios on platform to bring them back in line with target allocations.

Over recent months, South African asset classes, notably local equities, property, and bonds, have performed strongly, and the rand has appreciated. While this has been positive for portfolio returns, it has also resulted in portfolios drifting away from their target positions, increasing their exposure to risk assets beyond intended levels.

As a result, we believe it is now prudent to de-risk portfolios by rebalancing them back to their strategic asset allocations. This ensures portfolios continue to reflect the risk/return profile appropriate to each client’s mandate.

Rebalancing is a core component of our disciplined investment process, ensuring that emotion and market noise do not dictate portfolio decisions. By systematically bringing portfolios back to target, we reinforce the long-term consistency and risk management that underpin our philosophy, helping advisers deliver better outcomes for clients.

TIMING & PLATFORM PROCESSING

The rebalance is expected to be processed across most platforms* between the 10th and the 13th of November 2025. Please note that while the rebalance is being processed (which typically takes 1 to 2 days):

Withdrawals will not be processed; and

Change mandates can be instructed in WealthExplorer™ but, depending on the timing of the instruction, may only be processed by the platform on completion of the rebalance.

*The rebalance of the portfolios on the Allan Gray platform is likely to be processed slightly later, on the 25th of November 2025.

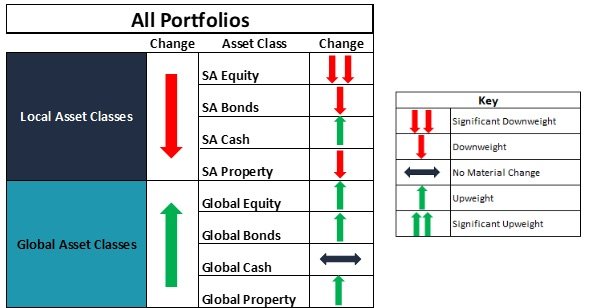

ASSET ALLOCATION ADJUSTMENTS

Below we provide a visual indication of what the trades within portfolios will look like:

These adjustments are not about taking a view on where markets might go next. Rather, they reflect our systematic and disciplined approach to portfolio management. By realising gains from areas that have performed strongly and reallocating to those that have lagged, we’re ensuring portfolios remain diversified and appropriately balanced. This measured rebalancing process captures the natural cycles of the market, helping to preserve the integrity of each client’s risk mandate and, over time, enhance long-term outcomes through consistent risk management.

CONCLUSION

We believe these changes appropriately balance the risks we see in the markets with the opportunity set available to us to produce inflation-beating returns.

Should you have any questions or require any information please contact us. We are always happy to chat.

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog