October 2025 & Global Portfolio Update

F&A Monthly Update | OCTOBER 2025

It's incredible to think we are wrapping up yet another year! This one has been special, not just for the quality of returns (more below), but for the depth of rhythm the F&A practice has entered in to. We deeply value our special relationships with each of you! It is so rewarding to see the strategies we build for you playing out successfully! It gives us great satisfaction to deliver on the trust you have placed in us, and we notice the peace it brings many of you. That look of hope, of confidence and contentment, is priceless. Truly moving, and motivating to me!

I love the fact that this business now has such a solid foundation. In just 8 months time, I finish paying off our founder, my ballie, for the business. It will be a wonderful moment for me, one where I ultimately fulfill a promise to not just my folks, but each of you, and quietly to myself. God has blessed me with so much and I look forward to deploying these incoming resources smartly, and with faith. If you are inclined, please do keep me in your prayers here! Exciting times ahead!

A quick but important note on our portfolios which continue to deliver! Local ones brought in between 16.3% and 19.8% over the past 1-year (depends on which one you’ve got). Global ones are right there too, with returns between 13.0% and 19.5% (depends on the portfolio and currency). These strong returns are useful by way of offsetting previous challenging periods. Most usefully, from an internal modelling perspective, these returns bolster the rolling 5 & 7 year numbers to ahead of our forward-modelling estimates, meaning each individual strategy is more robust for it. As shared many times over the years, it is best not to fall in love with the good times, or to be fearful of the bad! It is of course hard not to sheepishly grin a bit, but for us, nothing changes with our approach! Lets enjoy these times (just a little bit)!

I would like to extend my early end of year wishes to each of you! Mostly because I know you will each get many mails and messages with just that tune shortly, and end up being distracted and probably not reading mine. My hope for us each is a peaceful and joyful Christmas period. One with rest, and laughter and genuine love!

Sending love!

Cheers,

Richard and the F&A team

October 2025 Update

This piece is compiled by Philip Bradford - Chief Investment Officer (SA) - PortfolioMetrix.

Watch this short summary of the update below from Al (Alex's personal avatar):

Gold - Does is always glister as an investment?

Speed Read:

Gold can play a psychological or symbolic role, but not necessarily a central one in a portfolio. It’s better viewed as a volatile insurance policy than as an investment. PortfolioMetrix gains indirect exposure through diversified global equity holdings, without explicitly holding a gold asset.

Understanding Gold in Portfolios

Gold has been a focus of discussion recently as its price has risen sharply. While it’s often seen as a timeless store of value, the reality is more complex. To make informed decisions, investors should understand what gold is, why people might want to invest in it and what risks it carries.

What is gold and why do people buy it?

Gold is one of the world’s oldest investments, being mentioned over 400 times in the bible. It has emotional and historical appeal; it’s tangible, rare, and has long been associated with wealth. For many, gold represents a safe haven when markets are uncertain. Central banks also buy gold as part of their reserves, partly to diversify away from the US dollar.

However, gold is not a productive asset. It doesn’t generate income like interest from bonds or dividends from equities. Its price rises only when investors are willing to pay more for it. Unlike currencies, gold doesn’t earn interest, and storing or insuring it comes with costs.

Most gold demand comes from jewellery, with some use in electronics and dentistry. Investment demand can swing sharply, driven by factors like inflation fears, interest rate movements, and geopolitical tensions. Gold’s price can move suddenly, but not always in ways that investors expect.

What drives the gold price?

Gold’s performance tends to reflect a mix of four main influences:

Inflation and interest rates: When real interest rates (interest rates minus inflation) fall, gold often becomes more attractive since there’s less opportunity cost to holding it.

Government debt: High global debt levels can increase demand for gold as investors worry about financial stability.

Geopolitical tension: Wars, trade disputes, or political crises can push investors toward perceived safe-haven assets like gold.

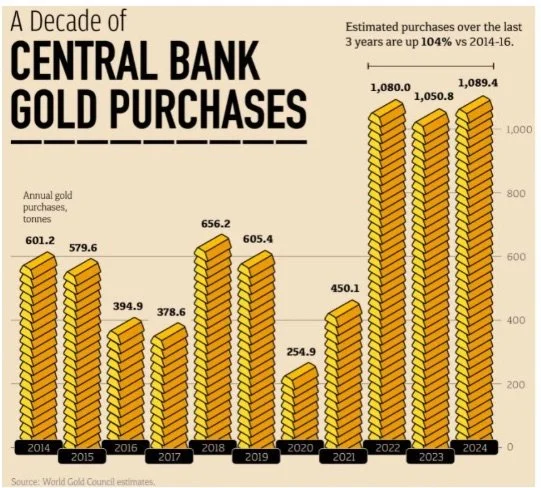

Central bank buying: Some countries, especially outside the West, have increased gold reserves in recent years.

Source: World Gold Council estimates, through Visual Capitalist

Yet, these relationships are inconsistent. For example, during the 2022 inflation surge and record high purchases of gold by central banks, when many expected gold to rise, its price actually fell. At other times, gold has rallied when inflation was low or when stock markets were strong, showing that it is not a reliable hedge.

The risks of investing in gold

Gold is often seen as a “safe-haven” investment, but history suggests otherwise. Its price is highly volatile, with large swings in short periods. Over some decades, investors have had to wait 30–40 years to recover losses after major drawdowns. For example, those who bought in the 1980s would have seen their investment fall for many years before breaking even.

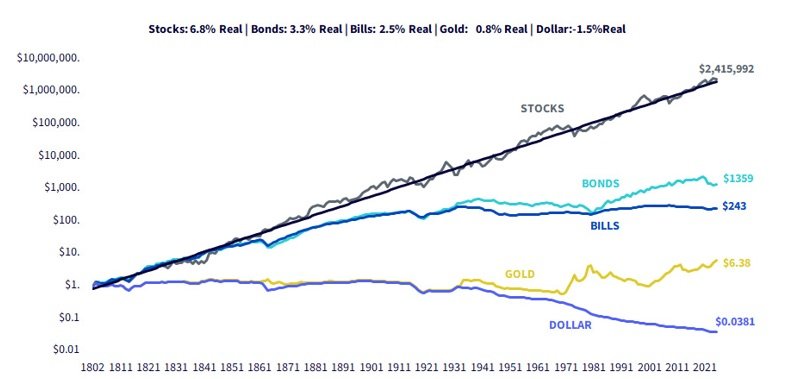

Gold can protect in certain crises, but not all. During stock market crashes, it sometimes holds its value, but at other times, it falls alongside equities. Over long periods, gold has underperformed both bonds and shares. It also offers no income and can lose purchasing power when other assets are rising.

Source: Jeremy Siegel, Stocks for the Long Run, via WisdomTree

Why PorfolioMetrix doesn’t include gold

At PortfolioMetrix, portfolios are built to balance return, risk, and diversification efficiently. Gold’s characteristics make it a poor strategic fit for several reasons:

Volatility: Gold’s price moves as much as, or more than, equities, but without the same return potential.

Unreliable diversification: While gold’s correlation with equities is low, it isn’t consistently negative, meaning it doesn’t always protect portfolios when markets fall.

Poor long-term returns: Over time, equities and bonds have significantly outperformed gold, while providing income along the way.

Indirect exposure already exists: Equity portfolios include gold mining companies. These provide a small but partial exposure to movements in the gold price.

PortfolioMetrix prefers to manage risk using assets with more predictable behaviour, such as bonds or cash, rather than relying on gold, which can be unpredictable and expensive to hold. Protecting portfolios is best achieved through sound diversification, not by tactically adding assets that may behave erratically.

When might gold have a role?

For some investors, gold may still hold emotional appeal or act as a small diversifier. A modest allocation might slightly reduce volatility in a portfolio, but may also lower returns without much extra benefit. It’s vital that investors understand why they are buying gold, as insurance rather than a growth driver, and accept its risks and costs.

Gold can look appealing when it’s performing well, but chasing its price often leads to disappointment. As Howard Marks famously said, investing is a “popularity contest” – the most dangerous time to buy is when everyone already has.

Global Update | October 2025

Provides an overview of current global market dynamics and essential insights.

Local Update | October 2025

Provides an overview of current local market dynamics and essential insights,

Performance Links

Global Portfolio Series Rebalance

This piece is compiled by Brendan de Jongh - Head of Global Investment Strategy - PortfolioMetrix

Introduction

The Global Portfolio Series is PMX's central solution for offshore investors. It is diversified across asset classes, managers, regions, currencies, sectors and styles and consists of the Core and Passive product sets, each utilising the same asset allocation process. However, the Passive product set implements this allocation exclusively through market-capitalisation weighted index funds.

At PMX, we continuously review client portfolios to ensure alignment with their strategic objectives. Rebalancing is a core component of our disciplined investment process, ensuring that emotion and market noise do not dictate portfolio decisions. Following a revised optimisation, adjustments will be made to the GPS range to reinforce the long-term consistency and risk management that underpin our philosophy, with the primary objective of delivering better outcomes for investors.

Asset allocation adjustments

Adjustments to asset allocation are neither a view nor a forecast on market direction. Rather, these modifications align with our systematic portfolio management approach. This methodology addresses inherent market cycles, upholds each client's risk mandate, and aims to improve long-term results.

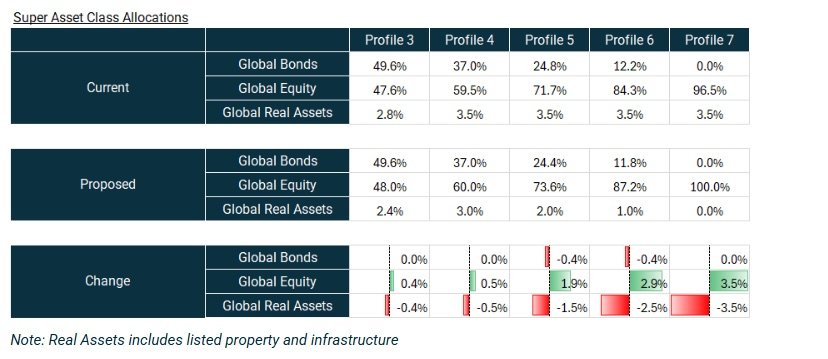

The following summarises the target asset allocation adjustments, by super asset class, for the GPS range. This will be utilised across both the Core and Passive product sets.

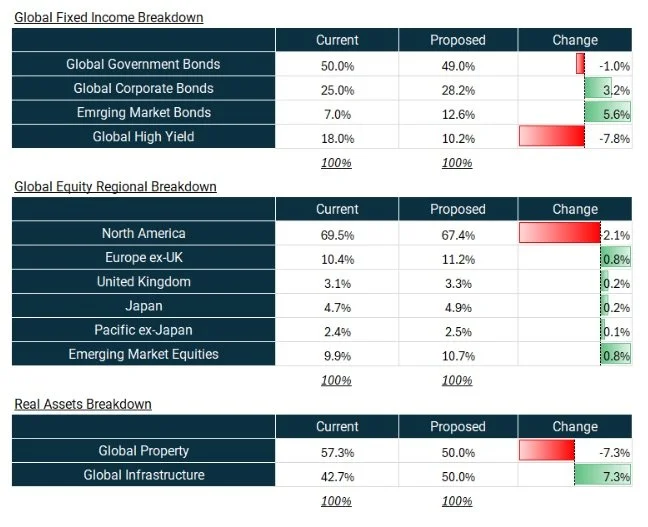

Below is a breakdown of each super asset class into its respective sub-asset class components. These proportions will be consistently applied to each portfolio according to its allocation to each super asset class.

Timing and execution

Since the GPS Core product set is structured using a combination of our two PMX UCITS funds, the bulk of the asset allocation changes will be made within the funds. The efficiency of this implementation also results in marginal changes to the fund weights for each Core Profile 1.

Trading within the UCITS vehicles has commenced, reinforcing the benefits of this investment structure. However, trading on platform of model portfolios (Core and Passive) is subject to the respective platform processes. Platform rebalances will begin in December 2025 2.

Conclusion

We believe these changes will assist with ensuring portfolios remain well-diversified and appropriately balanced, whilst improving the efficiency of portfolios.

Should you have any questions or require any information please contact us. We are always happy to chat.

Endnotes

1 The exact fund weights will vary per platform, based on operational, cash requirements of the platform.

2 The duration and specific dates of the rebalance vary based on platform processes.

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog