Q2 & June 2025 Update & Fund Commentaries

We're back with your latest quarterly and monthly updates. In this edition, we take a look at the key factors that shaped the investment landscape in Q2 2025, along with a quick wrap-up of June's market activity.

As always, these insights are brought to you by our partners at PortfolioMetrix. We hope you find them relevant, informative, and worthwhile.

Sending love,

Richard & the F&A team

This piece is compiled by Philip Bradford, Head of Global Investment Strategy - PortfolioMetrix

This message includes both the Quarterly Investment Update & Fund Commentary for Q2 2025, and the June 2025 Monthly Update. If you would like to jump ahead to each of these, please click the links below:

Maybe There Is No Such Thing as Passive Investing

REFRAMING A DEBATE THAT’S GONE ON TOO LONG

The active versus passive debate has long been a fixture in the investment world. Often framed in binary terms, it suggests that investors must choose between costly human intervention and cost-efficient automation. But the reality is more nuanced. And perhaps it’s time to ask a better question: what if the difference between active and passive is not so much about method as it is about mindset?

While passive investing plays a valuable role in portfolio construction, it’s rarely as neutral as it’s made out to be. Even the most rules-based, index-tracking investment involves a range of embedded choices. Recognising those choices helps us use passive tools more effectively – not dismiss them.

PASSIVE IN NAME, ACTIVE IN NATURE

Passive investing is often described as hands-off and objective. In practice, it's anything but. Every index is a human creation – designed with intention, shaped by assumptions, and revised over time.

Take the FTSE All-Share and the MSCI UK All Cap. Both are designed to represent the UK equity market, yet they differ significantly in their construction. For example, the FTSE All-Share and MSCI UK All Cap indices differ in their sector exposures, despite both aiming to represent the UK equity market. These differences arise from variations in index construction and stock inclusion criteria, leading to materially distinct allocations across areas such as financials, industrials, and consumer goods. As the chart illustrates, what seems like a minor structural choice can result in very different investment outcomes over time.

Even within the same index, implementation choices matter. One provider may replicate fully, another may sample. Some may engage in securities lending, others may not. Policies around rebalancing, cash handling, and execution quality vary widely. None of this is passive.

Then there's the S&P 500, one of the most widely used indices in the world. It isn’t rules-based in the purest sense; it has a selection committee that decides which companies qualify for inclusion. These are decisions – made by people – that affect every investor tracking that index.

UNDERSTANDING MARKET CONCENTRATION

One of the more frequently raised concerns about passive investing is rising market concentration. It’s true that many indices today are heavily weighted towards a small number of companies, particularly in the U.S. technology sector.

This isn't necessarily an error in the system. History suggests otherwise. Research shows that just 120 companies have accounted for over 60% of U.S. equity wealth creation between 1926 and 2022. Concentration, in other words, may be a feature of capital markets – not a flaw of index design.

Source: Vanguard calculations using data from Shareholder Wealth Enhancement, Bessembinder (2023). Data as of 2022. Calculations based on total net wealth creation of individual U.S. publicly traded stocks as a percentage of total U.S. net wealth creation from all publicly traded U.S. stocks.

Source: LSEG Datastream, MSCI ad Schroders Strategic Research Unit. Data as a 31 May 2025.

EVERY PASSIVE ALLOCATION IS STILL A CHOICE

Investing passively may appear to be a straightforward route, but in reality, it involves a number of intentional decisions. Choosing one index over another is not a neutral act; it determines regional exposure, sector tilt, and the kinds of companies you hold. The selection of a fund provider matters too – from how they track the index, to their handling of costs, rebalancing, and operational policies.

Even the overarching decision to prefer passive over active reflects an investment belief: that markets are broadly efficient, and that cost-effective exposure is preferable to the potential of active outperformance. These choices deserve just as much thought as any active investment decision.

WHERE ACTIVE STILL ADDS VALUE

None of this is an argument to abandon passive investing. Far from it. Used well, passive strategies are efficient and scalable. But they should not be used blindly.

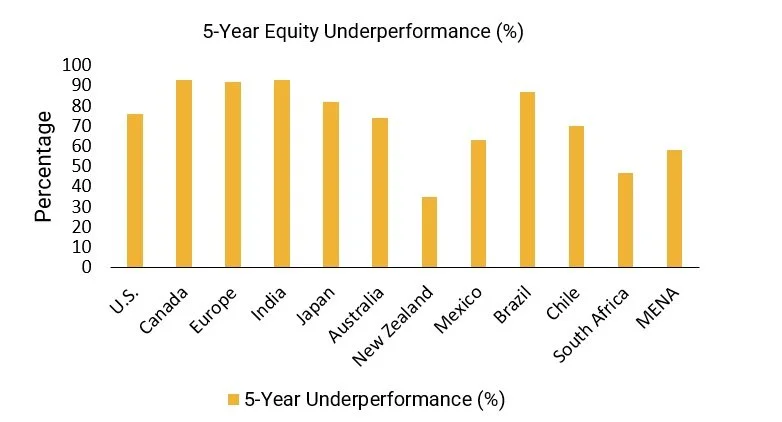

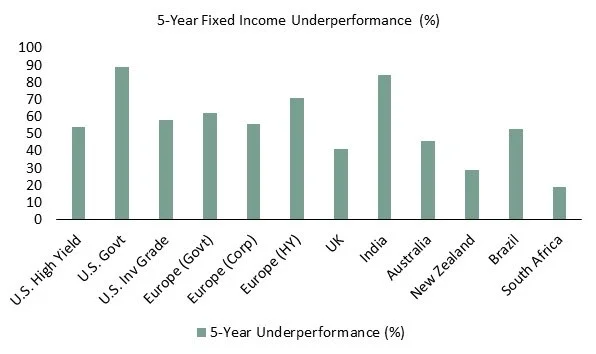

Active strategies still have a powerful role to play – particularly in areas where inefficiencies persist, such as smaller companies, emerging markets and complex credit markets. Good active managers take intentional, well-researched risks. They diversify sources of return and focus on repeatable processes rather than thematic hunches.

Source: SPIVA around the World 2025 and SPIVA Fixed Income Around the World 2025.

This kind of active investing doesn’t seek to time the market, but rather to apply judgement where market structure allows. Done well, it brings resilience, diversification and, over time, a more consistent client journey.

BLENDING FOR BETTER OUTCOMES

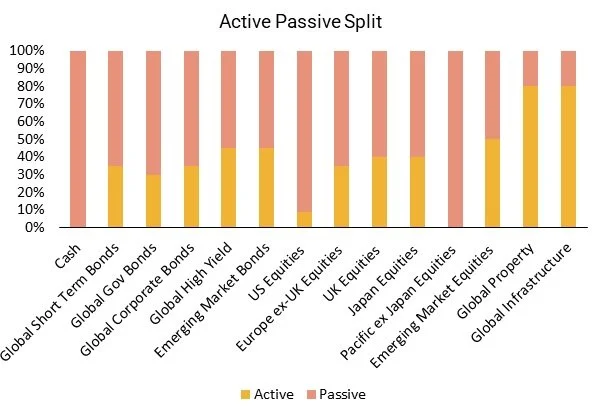

Passive exposures can deliver reliable, low-cost access to broad market returns. Active exposures, can introduce diversification and enhance return potential where market inefficiencies are present.

Crucially, the balance between active and passive should not be driven by a fixed formula. It is not linear. Instead, it depends on understanding where the inefficiency premia reside within a portfolio, and applying the appropriate approach accordingly. In well-researched, efficient markets, passive may be most suitable. In less efficient corners of the market, a skilled active approach may add meaningful value.

This bottom-up view allows you to design portfolios that are not merely cost-conscious but outcome-focused — built intentionally to balance systematic exposure with targeted opportunity.

Source: PortfolioMetrix, for Illustrative Purposes Only.

FINAL THOUGHT: THE DANGER OF LABELS

The real risk in portfolio design isn’t just being wrong. It’s being unaware. The term "passive" can give a false sense of safety, leading investors to overlook the hidden exposures they carry.

There may be no such thing as purely passive investing. But that’s not a weakness. It’s an opportunity to look deeper, to think more critically, and to be more intentional with every allocation decision.

Because at the end of the day, success doesn’t come from choosing a camp. It comes from understanding what you own, why you own it, and how it fits within the bigger picture.

Q2 2025 Update & Fund Commentary

Our Quarterly Commentary aims to carry and share the bulk of our reflections and analysis of the previous quarter. To help cater to your preferences, we've provided various avenues for navigating through an entire Quarter's worth of news and data.

You can view the full recorded feedback session (± 1 hour 2 minutes) here for a deep dive into the last quarter

The presentation slides are also linked below

And for the real meat, scroll a little further to find the full detailed commentaries on both South African (9 pages) and Global markets (8 pages) and portfolios

To catch up on past insights, please visit our blog for a recap of previous commentaries.

And, of course, if you'd like to engage in further discussion, please don't hesitate to reach out. We're always here and ready to chat.

PortfolioMetrix Recorded feedback session

The PortfolioMetrix team has recorded their feedback session, discussing a few key aspects from this last quarter. We trust you'll enjoy and find this summarised commentary valuable.

In our most recent quarterly update, Liam Dawson explores the concept of American Exceptionalism — is the US still the ‘City Upon a Hill’ or becoming a ‘Fortress in Decline’? Cutting through the noise, Liam shares objective indicators to ground this debate, before unpacking Charts That Matter, offering a sharp, data-driven snapshot of current market dynamics.

Philip Bradford then takes the reins and gives a Portfolio Update (performance and positioning). He illustrates how, despite global uncertainty and volatility, our clients have continued to benefit from a consistent, risk-managed investment approach (the power of Compounding Consistency).

Whether you missed the live session or want to revisit the insights, the full recording is now available below.

Quick timestamps for your convenience:

1:08 – American Exceptionalism

28:47 – Charts That Matter

35:08 – Portfolio Update

56:28 – Compounding Consistency

The Quarterly Feedback Session & Presentation Slides are linked below:

For the full Local & Global Quarterly Fund Commentaries, please click the links below:

Local Fund Commentary

Provides a commentary on the past quarter, its events and their impacts; as well as more intimate commentary on each moving part within your portfolios.

Global Fund Commentary

Provides intimate commentary on each moving part within your global portfolios over the past quarter.

June 2025 Update

Global Update | June 2025

Provides an overview of current global market dynamics and essential insights.

Local Update | June 2025

Provides an overview of current local market dynamics and essential insights.

Performance Links

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog