July 2025 Update

F&A Monthly Update | July 2025

We hope this message finds you in good spirits. As part of our ongoing commitment to keeping you in the loop, it's time for our monthly update! These updates provide a quick glimpse into market insights from PortfolioMetrix, giving you an overview of where your investments are headed. Here's your July 2025 update! Sending love!

July 2025 Update

This piece is compiled by Brendan de Jongh - Head of Global Investment Strategy - PortfolioMetrix

Watch this short summary of the update below from Al (Alex's personal avatar):

Why we’ll happily pay for Active Management - but only on our terms

As passive investing continues its surge in popularity, it would be natural to ask why anyone would pay more for active management. At PortfolioMetrix, we do pay more for active management, but we are very selective in only paying for proven skill, as well as being precise about when, where, and how much we invest in active management.

Investors no longer need active managers for basic market exposure, which can be easily gained through cost-effective passive funds. The true appeal of active management lies in the potential for additional returns (alongside risk management), and it is crucial you analyse fees in relation to the excess return above a benchmark you expect to gain, not just the total return. This approach sharpens our focus on genuine value, making sure every pound of active fee has a strong chance of delivering tangible results.

To outperform a passive fund, an active manager must deliberately differ from the benchmark and consistently demonstrate genuine skill, not luck. We avoid managers who rely on bold macro calls or style-timing bets as history shows that kind of forecasting doesn’t work.

The managers we partner with focus on building diversified portfolios filled with a basket of high quality, independent ideas that tilt the odds tilted in their favour. They size positions carefully, avoiding unrewarded risks like currency swings or big sector bets, and generate results through many small wins rather than rare, big hits. A higher fee is worthwhile when there’s strong evidence that skill will deliver value for clients above a benchmark.

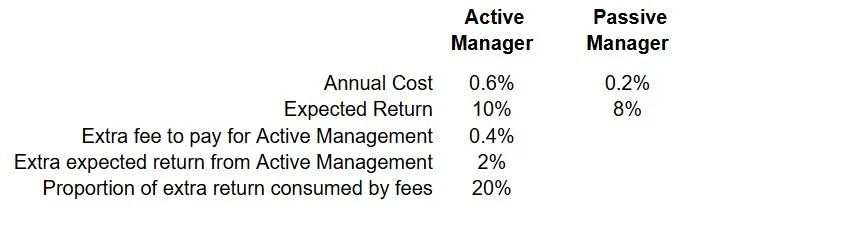

Even with a great active management partner you should expect higher fees, which we are fine to pay so long as it offers commensurate benefits. Consider this simplified example:

Paying 0.6% for a 10% return might seem appealing, but a simple passive strategy could capture most of that return at a much lower price (8% vs 10%). The true 'active cost' is the difference in fees (0.4%) for only the additional return (2%). To try get exposure to this it means giving up £1 out of every extra expected £5 for the chance to gain an extra £4 after costs. We would be comfortable making an allocation if we believe that managers skill and process would deliver the extra 2% above the benchmark before fees and believe it would be wrong to pass up this opportunity just to myopically focus on costs alone.

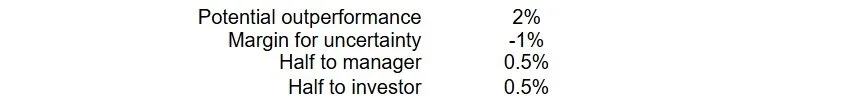

But given the higher true cost of active management, we think carefully about how expected outperformance is shared between the manager and yourselves as investors. Consider another simplified example to follow on from the example above:

This shows how we think about splitting the excess return. If a manager is expected to add 2% extra return but half of that is lost to uncertainty surrounding performance persistency, then just 1% is left to share. An equal split of 0.5% each keeps the example simple, but we want a fair and sustainable balance. If fees rise above this level, then an investor’s share shrinks to an insufficient number to justify paying extra for active management. In our two contrived examples, we would thus not pay the active manager 0.6% and would look to negotiate the fee paid to an appropriate amount.

Alongside returns and fees, we also consider risk management and consistency. Great outcomes often come from avoiding large losers rather than chasing big winners. The managers we support have strong frameworks for identifying and controlling risk, balancing capital between rewarded ideas, and ensuring portfolios aren’t unintentionally tilted toward uncompensated risks. If you try chase the winners, you have more chance of being a loser. These are two sides of the same coin and risk management needs to feature, especially when expected excess returns are high as there is no free lunch in finance.

Active and passive aren’t opposing camps. In many efficient markets, passive funds are the smarter choice. In less efficient areas where expected excess returns are higher, carefully chosen active managers can add genuine benefit and should be considered. Our role is to be precise in knowing exactly where active management belongs in a portfolio, and at what price, without compromising our risk-focused, long-term approach.

Active management is not a gamble on a get rich quick approach or star manager but is rather a part of a carefully engineered solution designed to keep clients invested and on track to their goals. When the conditions are right, we believe you should pay for active management. But we only do it on our terms, in a deliberate and disciplined manner designed to deliver real outcomes for clients.

Global Update

Provides an overview of current global market dynamics and essential insights.

Local Update

Provides an overview of current local market dynamics and essential insights,

Performance Links

Don’t leave without becoming an F&A insider

Sign up to receive regular business & investment updates from our blog